Beginning in mid-October, the PVC market experienced a wave of rapid decline, which caught spot participants by surprise, making the distribution of profits in the PVC upstream and downstream industry chain a roller coaster. As of November 8, the cumulative decline has reached 36%.

After the price fell rapidly, the market bubble has been greatly released, and market participants are beginning to pay attention to whether the current price has bottomed out?

Regarding this question, we need to look at whether the driving force of this rapid decline has changed, and whether the negatives have been exhausted?

First of all, the first driving force of the decline is the impact of the collapse of related commodities represented by coal. The rapid decline of coal has changed the logic of the expected reduction in production of Calcium Carbide and PVC when the PVC rose in the previous period, and the new logic has become that the supply side will increase production. , And this logic has also been confirmed in calcium carbide and PVC. At present, the price of coal may still not reach the end, but the impact on calcium carbide and PVC has been basically limited.

The second driving force for the decline is the rapid decline of raw material calcium carbide and the collapse of PVC cost support. The price of calcium carbide has indeed experienced a sharp drop. Turning losses into profits, PVC companies that outsourced calcium carbide have seen an increase in their start-ups. Therefore, the supply and demand relationship of calcium carbide will gradually improve, and the price of calcium carbide will also show signs of stabilization. The bottom of PVC cost is basically tested, so the negative effect of PVC cost collapse is also coming to an end.

On the whole, the negatives that led to the rapid decline of PVC prices are basically digested, so how about the performance of PVC fundamentals?

Upstream companies' net pre-sales increase

In the process of the rapid decline in the price of PVC in the early stage, the mid-stream and lower reaches of the panic were high, and the willingness to purchase was limited. According to the net pre-sale situation of sample companies from Zhuo Chuang Information, the net pre-sale volume has continued to decline, but with the rapid decline in prices, the terminal demand has improved since last week, and the net pre-sale volume of PVC companies has also increased slightly. .

PVC companies are expected to continue to improve production

Recently, on the one hand, there are too many companies undergoing routine maintenance. On the other hand, PVC has just experienced a wave of profitable roller coasters. In the first two weeks, the industry has experienced obvious losses. This has led to a decline in the enthusiasm of PVC companies that purchase calcium carbide from the bottom, so the overall load has been slowly rising from the bottom. . However, due to the rapid decline of the raw material calcium carbide, the current PVC profitability has also been significantly improved. Take the PVC companies that outsourced calcium carbide in Shandong as an example. As of November 8, the profit has exceeded 700 yuan/ton. Therefore, the PVC companies that purchase calcium carbide out of these days The increase in load began to occur, and the previous routine inspections of PVC have basically returned to normal, so it is expected that subsequent PVC starts will continue to increase.

On the whole, the bad news that drove the rapid decline of PVC in the early stage has come to an end, the market panic has subsided, the risk of mid- and downstream procurement has weakened, the rigid needs are improved, the upstream pre-sales have increased, and the fundamentals have improved. The enthusiasm for subsequent external purchases is also expected to increase, so the PVC market has entered the process of bottoming. However, the profit of the upstream and downstream industry chain of PVC has not yet reached a balance. Whether the terminal demand is really heavy still needs attention. With the increase in PVC production and the release of production, there is still uncertainty about whether the fundamentals of PVC can continue to improve, so prices are driven upwards. The performance is vague, and it is expected that the market will fluctuate mainly at the bottom in the short term.

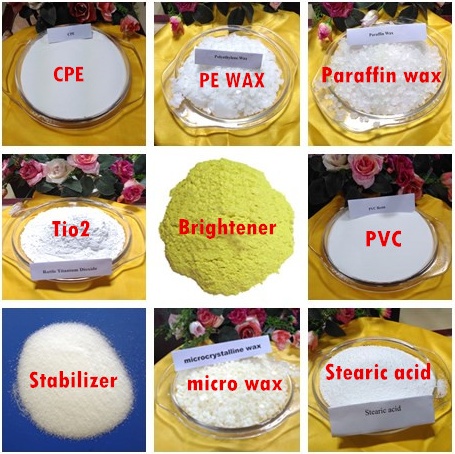

We have done chemical products for over 30years. Our main products include PVC Resin, CPE, TIO2,PE WAX, Paraffin Wax, Stabilizer ETC.